Content Auto-Population TEST - Related Products

September 25, 2023

Executive Summary:

- The Federal Reserve (Fed) remained on hold with the Committee split on whether any additional rate increases are necessary.

- The Summary of Economic Projections (SEP) signaled increased confidence in both a soft landing and that higher interest rates are here to say.

- Powell was left with the unenviable task of discussing the optimistic forecast in the SEP without giving an inch on the Fed’s resolve to do more if necessary to return inflation to 2 percent. We continue to think that the last hike occurred in August.

- This late-cycle environment can persist for some time before either a recession or the Committee feels confident to begin reducing interest rates.

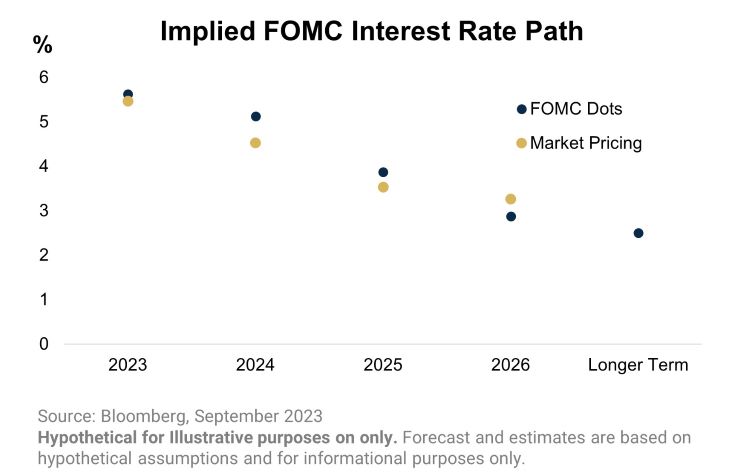

The Federal Open Market Committee (FOMC) left rates on hold at their September meeting with a near even split about whether to increase rates further in 2023. In the aftermath of the meeting, investors’ focus centered on revisions to the Committee’s SEP forecasts. Beyond the slight tilt towards one additional increase in 2023, the median dot1 increased by 50 basis points for both 2024 and 2025 with the constellation of dots implying that most, if not all, policymakers see higher interest rates for longer. Meanwhile, despite the increased rate path, estimates for growth increased, for the unemployment rate they declined, and for inflation they barely budged. The clear inference from the SEP revisions is that the Committee sees a stronger economy and that a soft landing is the most likely outcome for this hiking cycle.

The other takeaway is that Committee members appear to be abandoning their low interest rate priors. You do not see that in their estimate of the long-run dot, but that’s more a function of how poor of a signaling device that estimate is rather than evidence in favor of low neutral rate priors. As Powell said in the press conference, the neutral rate is only clear after the fact. So far, the economy’s strength suggests that the long-run estimate of 2.5 percent is too low, and the rate path was revised higher as a result. If the Committee is in fact shifting that way, the distribution of future interest rates will be higher. Revisiting the 2 percent interest rates will require a recession and the odds of returning to the zero lower bound are much lower as well.

Despite interest rates trading well above 2.5 percent for some time, we think the market shared the FOMC’s low-rate prior. Maybe interest rates could stay elevated until the Fed ceased hiking, but the perception was that the skew to interest rates was to the downside. If the market abandons this assumption, we think equity valuations are most at-risk. Equity risk premia is near the low end of its historical distribution already reflecting a mixture of optimism on the fundamentals and the likelihood that lower interest rates were forthcoming. The Fed’s outlook is consistent with strong fundamentals, which provide a floor for equity prices, but we think a multiple contraction is more likely than a material expansion from here.

Stuck in the Middle With Jay

Our regime model mirrors where the Fed finds itself, at the mercy of near-term inflation and labor market data to get direction. The economic data remains robust, and the consequences of the Fed’s hiking cycle appear limited so far. The late-cycle environment could tip either way, into a recession or a reacceleration. We continue to lean towards a recession as the most likely result. Consumer spending is riding on a very low savings rate, high interest rates are slowly working their way on to company balance sheets, and other major economies are struggling. However, the U.S. economy has surprised us time and again since COVID.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

1 Please reference the “dots” on the following illustration, which represent the hypothetical interest rate path mentioned.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

A basis point is one hundredth of one percentage point.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

3128316

3128316 - TEST