August CPI: Progress Where Progress is Due

September 18, 2023

Executive Summary:

- In August, U.S. Consumer Price Index (CPI) printed at 0.6% month-over-month for headline and at 0.3% month-over-month for core. The increase was primarily driven by a 5.6% month-over-month surge in energy prices, while airfares and auto insurance contributed to core inflation.

- Despite a slightly stronger print, the factors that led to favorable inflation numbers in previous months remain unchanged.

- It is expected the Fed will hold rates steady at the September Federal Open Market Committee (FOMC) meeting. However, the Fed’s decision in November will depend on incoming data. If CPI continues to show strength over the next few months, the Fed may consider resuming rate hikes.

- While we remain cautiously optimistic about the inflation outlook, the resilience of the U.S. economy could pose a risk to further disinflation.

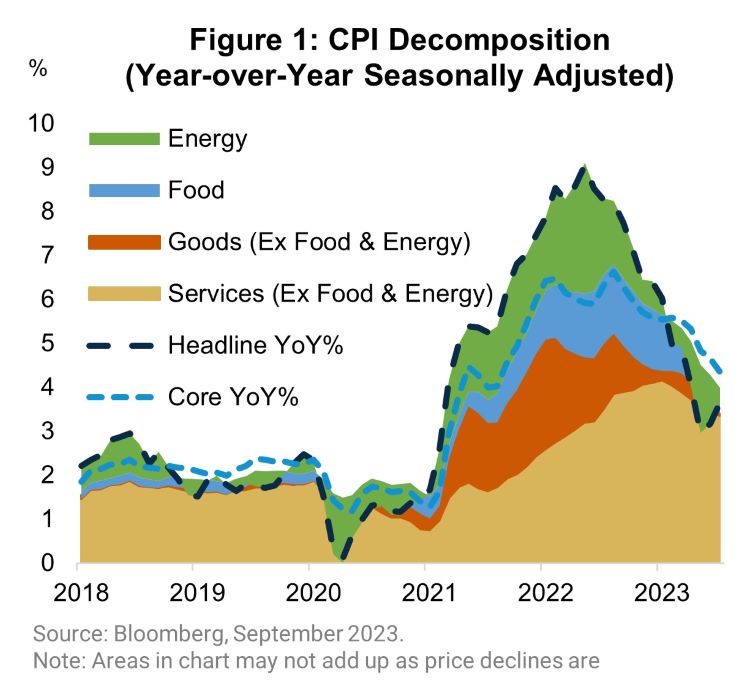

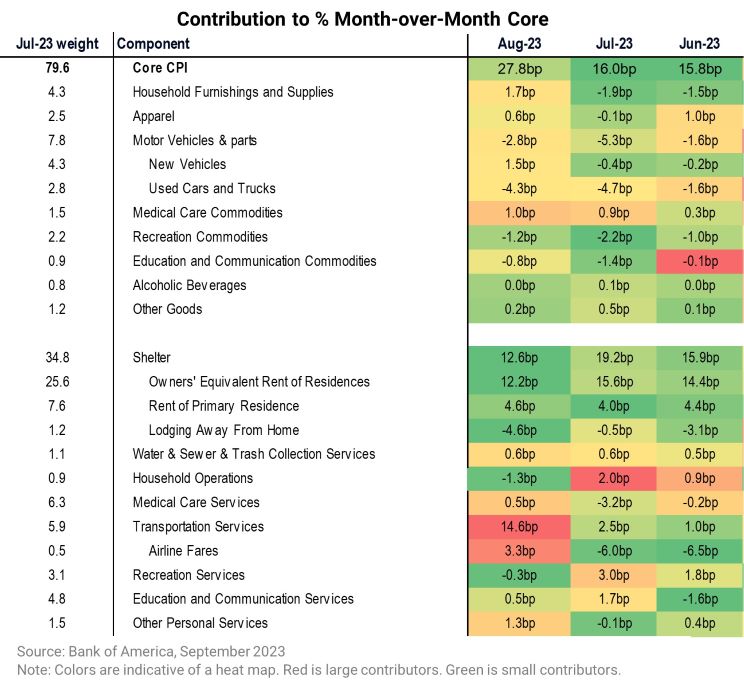

After a summer of subdued CPI prints, August’s headline CPI increased by 0.6% month-over-month, while core rose by 0.3%. On a year-over-year basis, core inflation declined to 4.4% while headline inflation increased from 3.3% to 3.7%. The rise in energy prices was the primary driver of headline inflation, with airfares and auto insurance accounting for much of the firmness in core. Despite the uptick in monthly CPI figures, the overall trajectory of inflation remains positive. The Fed is comfortable overlooking the volatility in energy prices, especially when inflation expectations are well-anchored. Both the Fed and the markets remain most focused on core inflation, particularly core services excluding housing, which is running at an annualized rate of 2% over the last three months and 2.6% over the last six months.

Transportation services drove the firmness observed in core CPI. Higher oil prices likely contributed to the increase in airfares; however, the Fed is unlikely to put too much weight onto this. There are signs that the recent rise in airfares might not last long, as Q3 earnings guidance indicates a potential decrease in fares due to increased promotional activity, stemming from a decline in consumer demand. Another area displaying resilience is auto insurance, with monthly price increases consistently around 2% month-over-month since May. Auto insurance premiums exhibit a strong, lagged correlation with used car prices. Although we have not seen a peak in auto insurance prices, it is probable that auto insurance inflation will revert to historical norms as used car prices continue to stabilize.

Other components of core inflation appear favorable. Shelter inflation slowed to 0.3% month-over-month, and core goods printed at -0.1% month-over-month. Looking ahead, we anticipate shelter inflation to continue slowing, and three consecutive months of negative goods inflation signal that the price increases in that sector have returned to their historical norm.

A Head-Fake, or Cause for Concern?

It is natural to be concerned when both headline and core inflation rise simultaneously, as even slight increases can trigger worries about a shift in inflation momentum. However, the Fed has consistently reminded us that the path to achieving 2% inflation was never expected to be entirely smooth. While the stronger CPI print may be disconcerting, it does not alter the broader inflation outlook. We anticipate a continued easing of shelter inflation and normalization of supply shocks. We also expect a further slowdown in wage growth, though that is contingent on the labor market easing. Overall, this lends to a reasonably comfortable inflation environment. The Fed is likely to take a pause in September, with their November rate hike decision dependent on incoming data. Unless there is notable upside pressure on inflation, we believe their bias is to keep rates steady in November.

Although the inflation outlook remains positive, there are risks to consider. The primary risk is that economic growth is too strong, leading to robust consumer spending or a re-tightening in labor market conditions, both of which could drive core inflation higher. In this scenario, additional rate hikes may be necessary to curb inflation. The trajectory of inflation allows for optimism, but the Fed will continue to be cautious against prematurely declaring victory.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

3120461