Core Fixed Income

Opportunities & Considerations for 2024 & Beyond

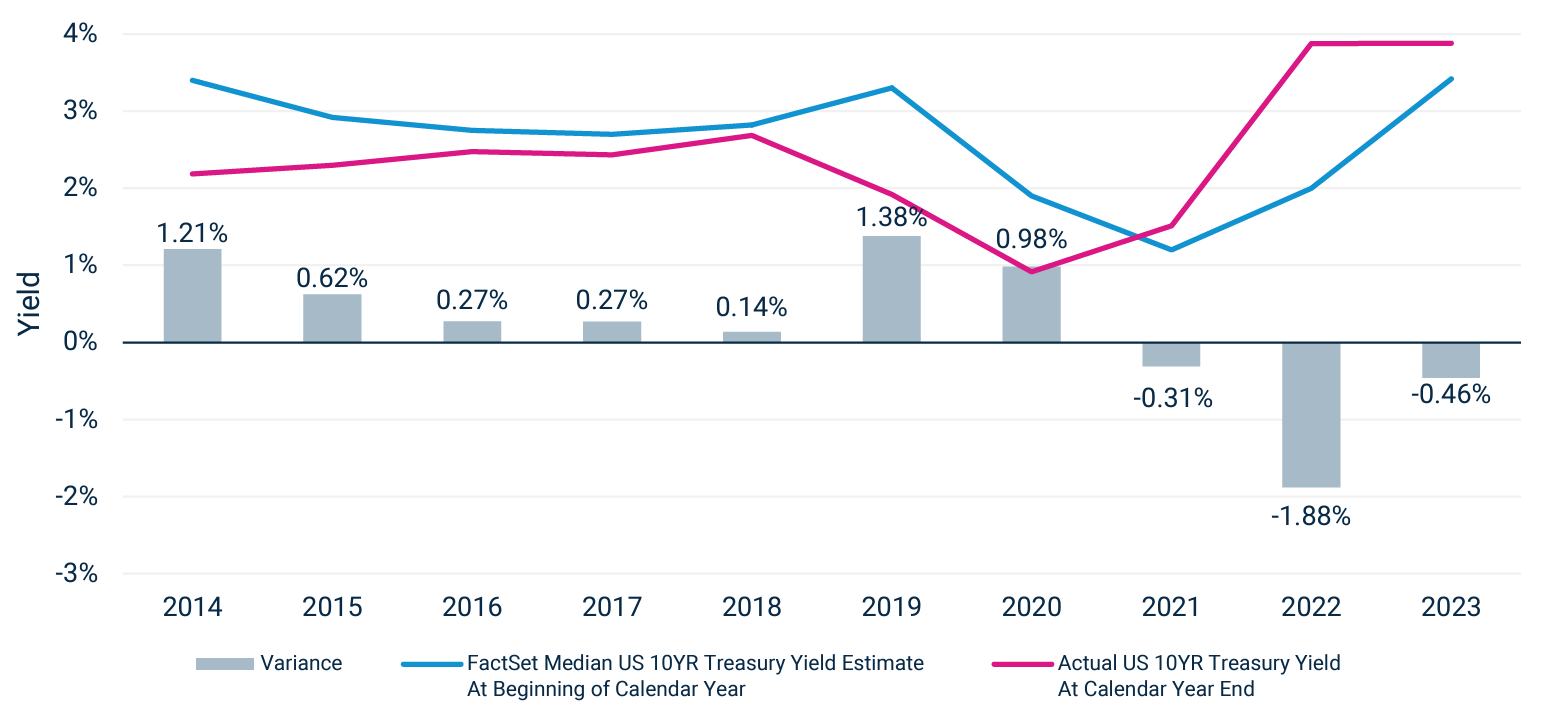

August 23, 2024- Since FactSet began tracking economist calendar year U.S. 10-year Treasury yield forecasts in 2014, median predictions have only come within 20 basis points of actual year end US 10YR Treasury yields once (in 2018)

- On an absolute value basis, median forecasts have varied from actual yields on average by 75 basis points over the last 10 years

- The trend lines show that not only have forecasts been off in terms of yield timing, they've also at times been off in predicting the direction of interest rates (such as in 2021)

vs. Actual US 10YR Treasury Yield Estimates

2014-2023

Source: FactSet Research Systems. Performance data shown represents past performance and is no guarantee of future results.

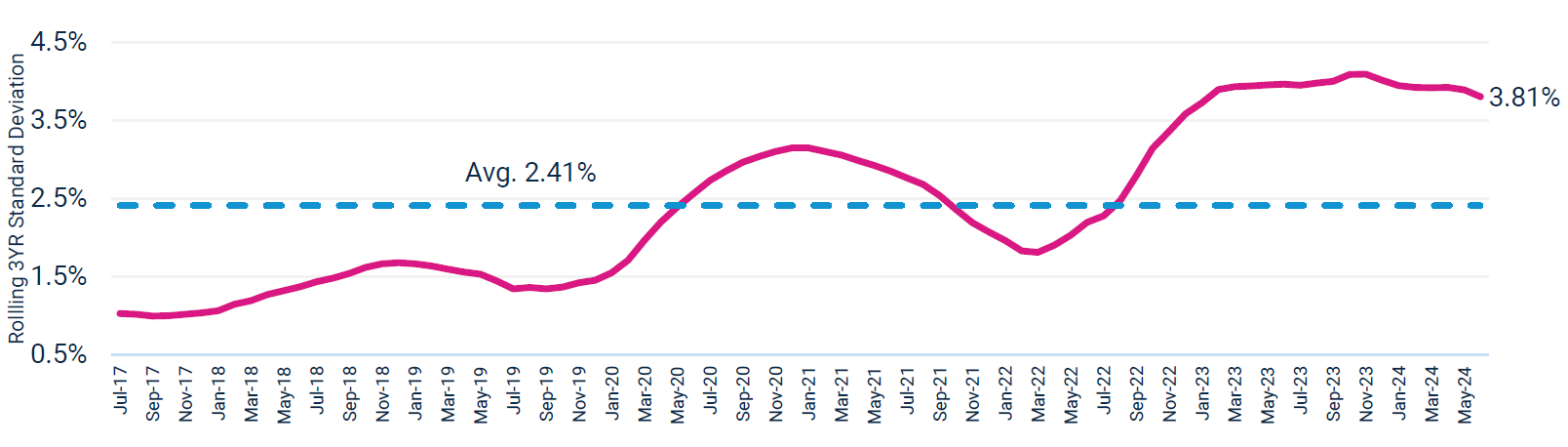

- Interest rate volatility has become elevated since early 2020

- The rolling 3-year standard deviation of the U.S. 10-year Treasury yield has increased to 3.81% as of 6/30/2024; this is 1.6x greater than its 10YR average of 2.41%

Rolling 3YR Standard Deviation

July 2014 - June 2024 (Monthly)

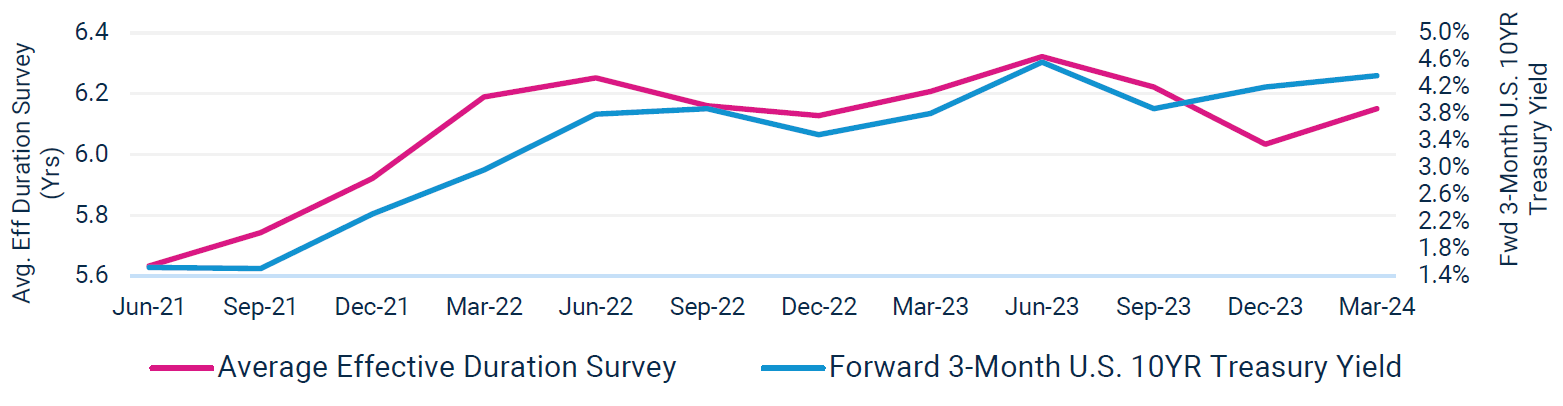

- Active Intermediate Core Plus Funds have recently experienced challenges in timing duration bets

- Over the last 3 years, on average, category funds have generally decreased or increased duration only to see rates move in the same direction three months later

- Amidst a backdrop of heightened interest rate volatility, duration neutral, security selection-driven strategies appear well positioned for the road ahead

vs. Forward 3-Month US 10YR Treasury Yield

Jun 2021 - Jun 2024 (Quarterly)

Source: FactSet Research Systems. Performance data shown represents past performance and is no guarantee of future results.

Active funds include open-ended mutual funds which are not index funds and enhanced index funds, as defined by Morningstar.

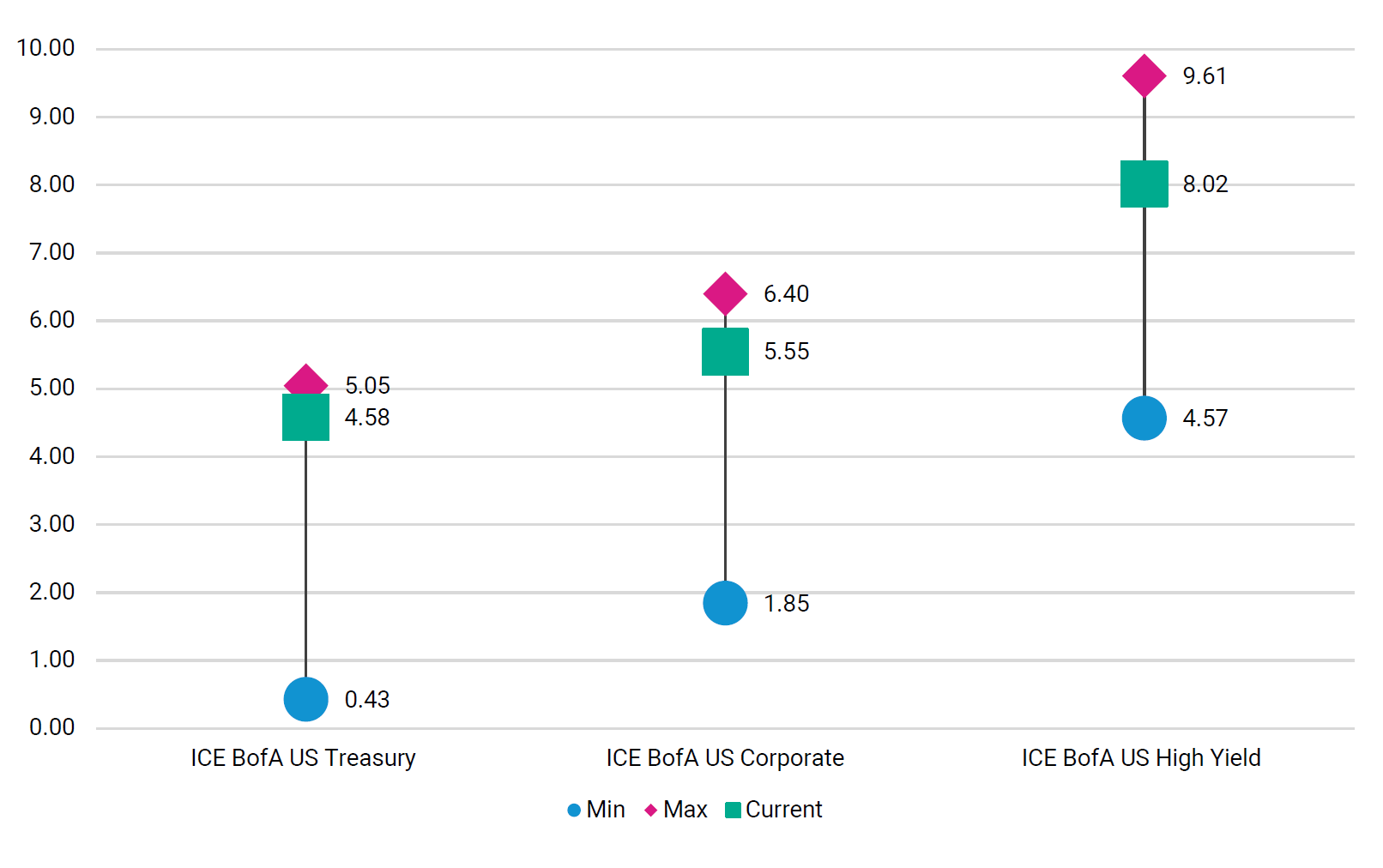

- After bottoming amidst the pandemic in 2020, effective yields have generally risen across the fixed income landscape

- Compared to the last 10 years, ending June 2024, current yields for areas such as U.S. Treasuries, Investment Grade U.S. Corporates and U.S. High Yield bonds are higher than average on an absolute basis

Source: FactSet Research Systems. Performance data shown represents past performance and is no guarantee of future results.

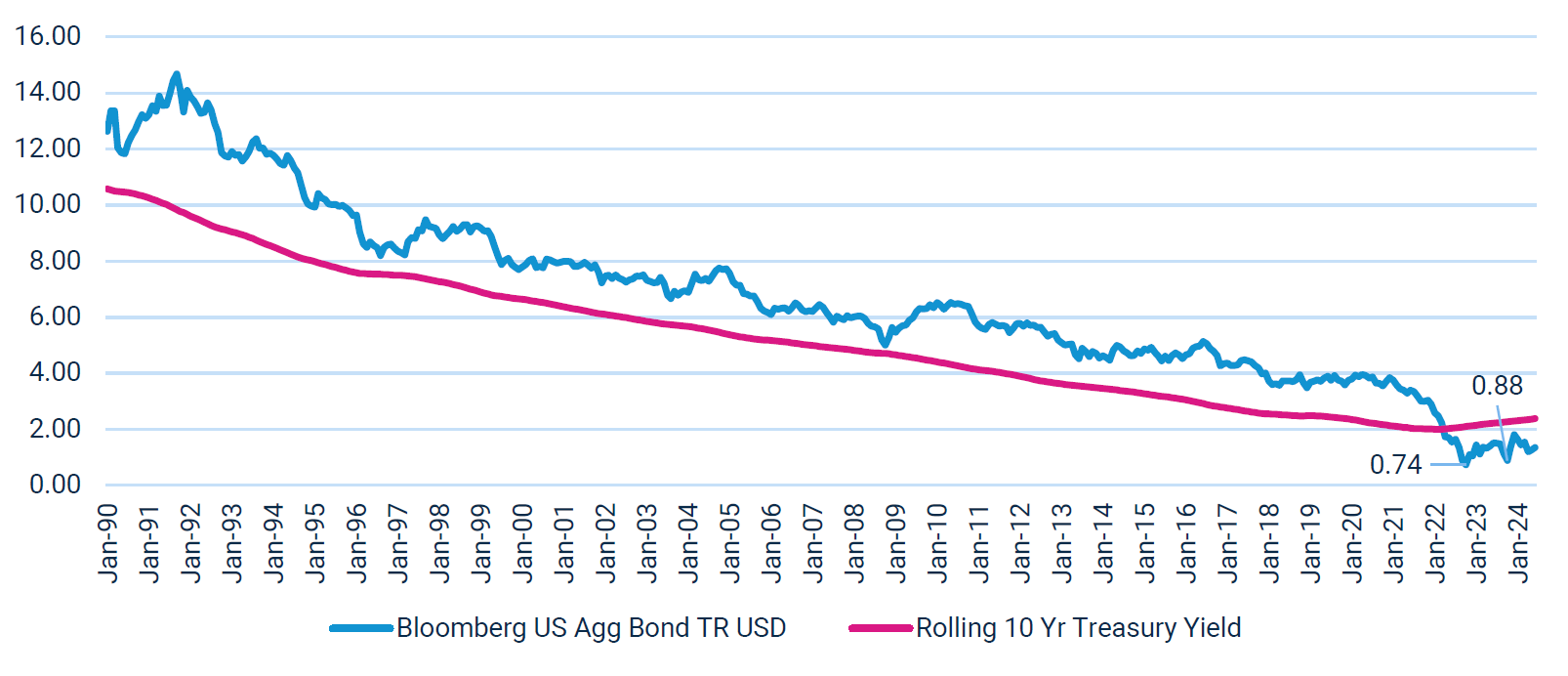

- Over the long-term, returns for Core/Core Plus fixed income have been highly correlated with prevailing yields

- Specifically, the chart on the right shows the rolling 10-year return of the Bloomberg U.S. Agg Bond Index vs the rolling U.S. 10-year Treasury yield back to the Agg's inception in 1980

- A few key points that stand out:

- The correlation between these two data sets has been 0.97 – meaning that lower rates have coincided with lower returns, and vice versa

- Falling interest rates for many years leading up to the pandemic nearly led to a “lost decade” for the Bloomberg U.S. Agg Index, with 10-year returns ending 10/31/2022 and 10/31/2023 lower than 1%

- Aside from Apr 2022 – Dec 2023, long-term Bloomberg U.S. Agg Returns have consistently outstripped 10-year Treasury yields, highlighting the advantages of compounding spread income over time (yield over treasuries of U.S. corporate and Securitized sectors within the Bloomberg U.S. Agg Index)

Jan 1980 - Jun 2024 (monthly)

Source: FactSet, Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results.

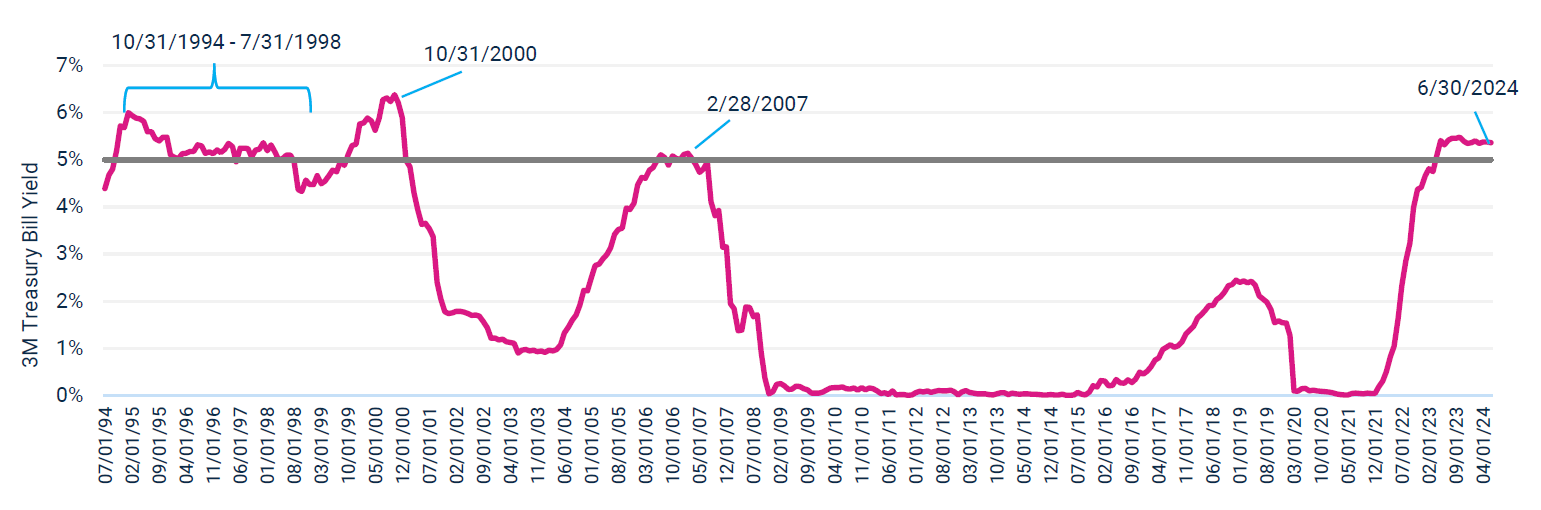

- Driven by the fed's historic hiking cycle, short rates rose above 5% in mid-2023, most recently peaking at 5.48% on 10/31/2023. This has driven some investors to question whether they need to take on credit risk. History may serve as a guide offering potential insight on this consideration.

- Over the last 30 years there have been three periods where the US 3 Month Treasury Bill has exceeded 5%: a prolonged period in the mid-to-late 1990's, in late 2000 and in early 2007.

- Through the mid-to-late 1990's when short rates remained elevated above 5%, core bonds delivered 405 basis points in annualized excess return.

- Following the >5% peak of short rates in late 2000 and early 2007, core bonds went on to outperform in both cases over the subsequent 1YR, 3YR and 5YR periods

- These periods highlight the benefits of compounding spread and core bonds' ability to outperform whether short rates remain elevated (late 1990's) or fall (2000 and 2007).

Trailing 30 Years Ending 6/30/2024

| 10/31/1994 - 7/31/1998 | |

|---|---|

| Total Return | |

| ICE BofA US 3M Treasury Bill | 5.52% |

| Bloomberg US Agg Bond | 9.57% |

| Subsequent Returns From 10/31/2000 | |||

|---|---|---|---|

| 1YR | 3YR | 5YR | |

| ICE BofA US 3M Treasury Bill | 5.17% | 2.75% | 2.43% |

| Bloomberg US Agg Bond | 14.56% | 8.37% | 6.31% |

| Subsequent Returns From 2/28/2007 | |||

|---|---|---|---|

| 1YR | 3YR | 5YR | |

| ICE BofA US 3M Treasury Bill | 4.85% | 2.14% | 1.32% |

| Bloomberg US Agg Bond | 6.65% | 6.18% | 6.38% |

Source: Morningstar Direct. June 2024. Performance data shown represents past performance and is no guarantee of future results.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

Past performance is no guarantee of future results.

The Bloomberg US Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

© Morningstar 2024. All rights reserved. Use of this content requires expert knowledge. It is to be used by specialist institutions only. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

A basis point is one hundredth of 1 percentage point.

Duration is a commonly used measure of the sensitivity of the price of a debt security, or the aggregate market value of a portfolio of debt securities, to change in interest rates. Securities with a longer duration are more sensitive to changes in interest rates and generally have more volatile prices than securities of comparable quality with a shorter duration.

Standard deviation measures the dispersion of a dataset relative to its mean.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Diversification does not assure a profit or protect against loss in a declining market.

Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

3827704