ETF Creation & Redemption

In a watershed event, the first mutual fund in the U.S. was created in 1924, revolutionizing how investors could purchase and sell baskets of stocks, bonds, or commodities. More recently, the U.S. launched its first ETF with an updated structure that allows for more tax efficiency.

Although both mutual funds and ETFs are typically structured as open-end funds, the later initiation of ETFs into this investment structure family means that they feature some differences versus mutual funds. Namely, ETFs are eligible to be traded on an exchange and throughout the trading session.

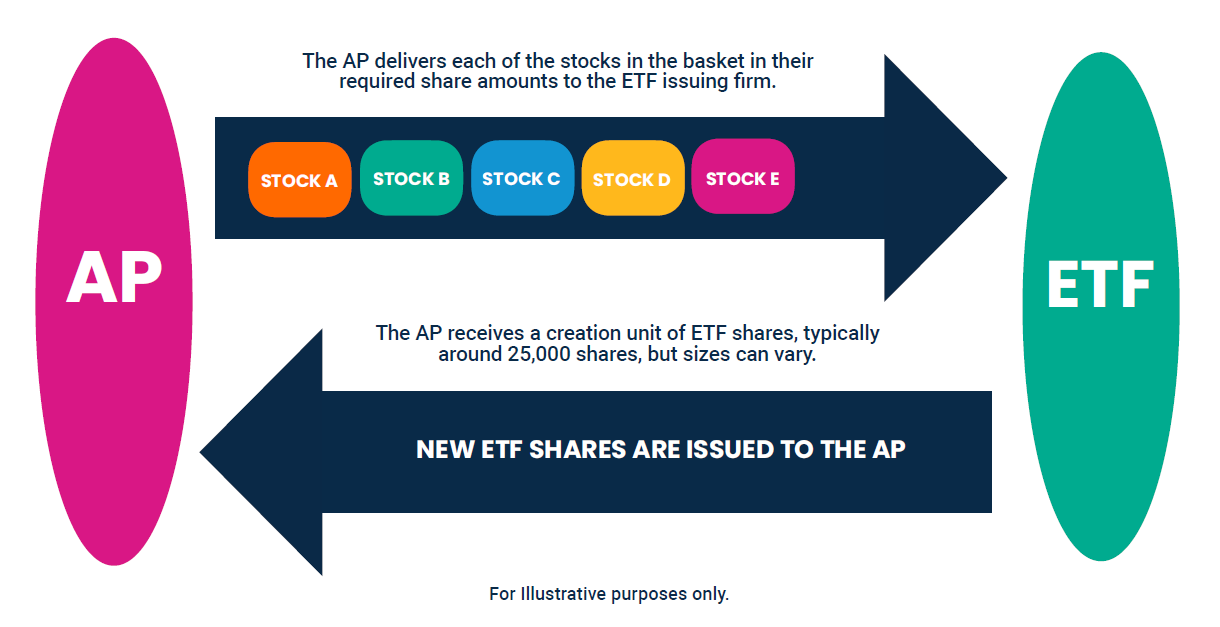

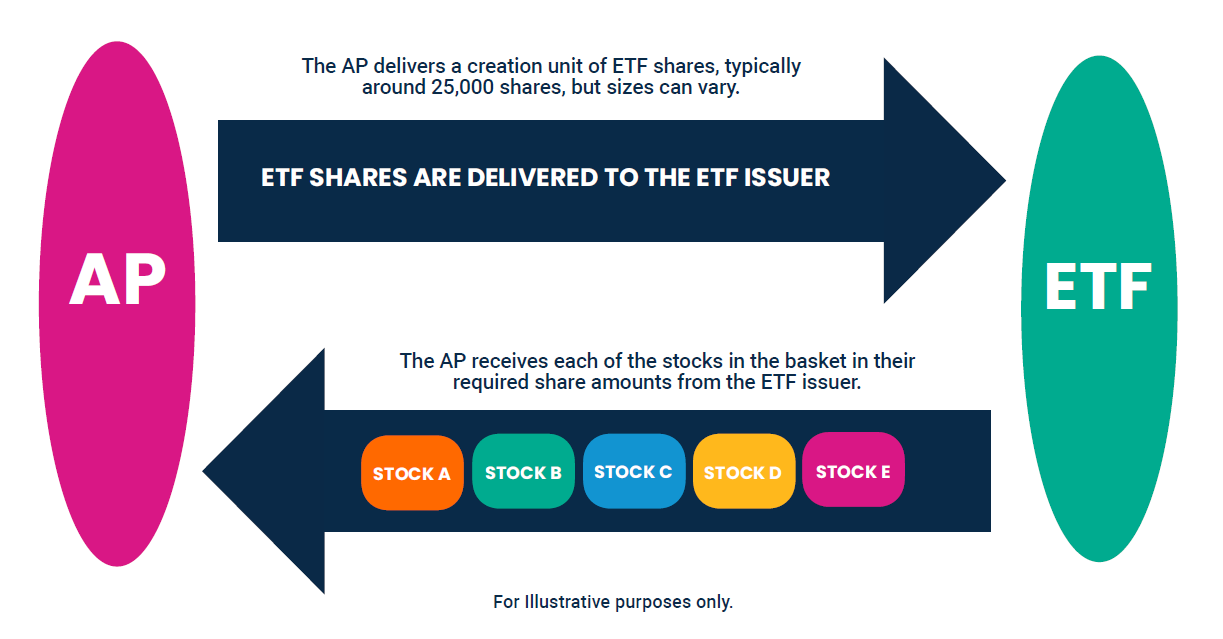

This occurs with the help of market makers, some of which are authorized participants (AP), that stand between the ETF and the investor and typically provide a two-sided market on the exchange for the ETF. The AP is authorized to transact with the ETF to either create or redeem shares of the ETF.

Here is a diagram of how a typical in-kind ETF creation works:

Here is a diagram of how a typical in-kind ETF redemption works:

During an in-kind ETF redemption, an AP returns a block of ETF shares via creation units to the ETF issuer and receives the corresponding basket of the underlying ETF securities. An investor that typically purchases their ETF shares on the secondary market via an exchange can then sell their ETF shares at the current market price but does not participate directly in the in-kind redemption process.

Important Information

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

Please refer to the appropriate Prospectus, or the Tax Center for general tax information about any of the Harbor funds. The information provided should not be construed as specific tax, legal or investment advice. If you have questions, please consult with your tax adviser to determine the appropriate use of this information for your tax situation.

4021449