GDIV: Growing a Long-Term Perspective

August 21, 2023

The first seven months of 2023 featured record high index concentration in the S&P 500 Index and strong returns for the “magnificent seven,” consisting of NVIDIA, Meta Platforms, Tesla, Alphabet, Amazon, Apple and Microsoft. Subsequently, dividend growth strategies that typically lack exposure to these types of companies lagged on a relative basis. That said, we believe that an active manager’s ability to uncover winners in other areas of the market has the potential to create opportunity as these mega cap stocks may eventually underperform relative to the broader market.

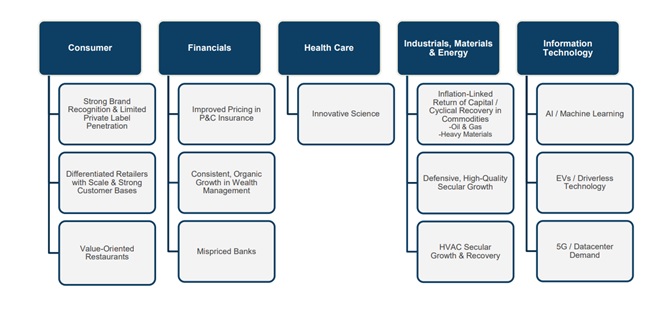

Importantly, the Harbor Dividend Growth Leaders ETF (GDIV) possesses diversified exposure across economic sectors based on where we are identifying the best risk-reward dynamics.

As shown above, GDIV’s exposures span a range of sectors and attractive growth themes. No matter the point in a market cycle, GDIV prioritizes companies that have the potential to sustain and grow their dividends as critical in capital preservation and growth. GDIV’s focus on high-quality companies with compounding growth tend to work well over time, making it an attractive option for a core allocation in client portfolios.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Investments involve risk including the possible loss of principal. There is no guarantee the investment objective of the Fund will be achieved. The Fund's emphasis on dividend paying stocks involves the risk that such stocks may fall out of favor with investors and under-perform the market. There is no guarantee that a company will pay or continually increase its dividend. The Fund may invest in a limited number of companies or at times may be more heavily invested in particular sectors. As a result, the Fund's performance may be more volatile, and the value of its shares may be especially sensitive to factors that specifically effect those sectors. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, government sanctions, social and economic risks. Foreign currencies can decline in value and can adversely affect the dollar value of the fund.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Diversification does not assure a profit or protect against loss in a declining market.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

Westfield Capital Management, L.P. is the subadvisor for the Harbor Dividend Growth Leaders ETF

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

3075248