Inflation: Transitory or Enduring?

July 02, 2021

Executive Summary

- The dramatic change in market inflation expectations over the past year resulted from a remarkable confluence of events. Although some supply disruptions are likely to subside over time, we expect underlying price pressure to continue building and last long enough to become self-fulfilling.

- Recently the Fed has acknowledged inflation exceeding their initial expectations. We expect this to be the first step in an evolving policy change which will result in earlier tapering and rate hikes than embedded prices suggest.

- Counter-trend trade opportunities may arise, but the best way to play this change is through increased exposure to high-quality cyclicals with a preference for those with pricing power who can drive pricing to offset cost increases and grow earnings/expand margins.

How Did We Get Here?

Before addressing the current debate on inflation, we think it is important to remember the path we took to get here. It was not long ago that interest rates were marching steadily towards zero and the risks to the financial system centered on negative yielding interest rates and yield curve inversions.

Fast forward only a few short months and the world looks very different. News of a highly contagious and novel coronavirus drove governments across the globe to enact severe mobility restrictions. In lockstep, companies scrambled to transition work forces to a remote environment where possible, while others, unable to do so, were required to shutter operations. Productive capacity was severely limited, as was demand for goods and services. Fearing the worst, many businesses battened down the hatches, furloughed employees, and hoped to make it to the other side of the pandemic.

While demand for some goods and services dried up entirely, the demand for others overwhelmed the existing supply by a wide margin as wallet-share shifted abruptly from categories like travel, leisure, and entertainment to areas such as home furnishings, home improvement, and personal consumer technologies. The swift fall in demand during the initial lockdowns was countered with an equally swift recovery that, in some areas, exceeded pre-pandemic levels. With widespread supply chain disruptions, COVID protocols, and companies competing with unemployment / stimulus benefits for labor, manufacturing and commodity businesses faced an incredibly challenging dynamic to meet end-market demand.

Making matters worse, extreme weather in Texas - a major petrochemical industry hub with inputs into manufacturing across the country – disrupted operations and compounded problems, leaving supply shortages and bottlenecks throughout the value chain. As one could expect, insatiable demand and limited supply drove prices meaningfully higher. Operators closest to the mine, so-to-speak, pushed prices higher as they balanced demand with tight supply. Those further downstream were confronted with rising input costs across the board (commodity, transportation, labor) and were forced to push through price increases to maintain profitability. Consumers, many of whom were flush with cash through excess savings and government stimulus, have largely accepted these price increases to date, which brings us to the current debate: Are the current price spikes a harbinger of what is to come or only a temporary shock?

Westfield’s Take on the Inflation Debate:

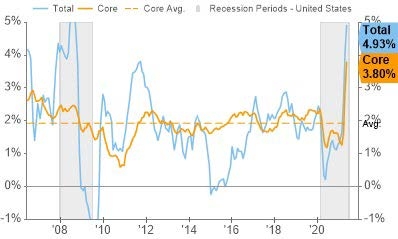

Much ink has been shed on the topic lately and based on the muted market reaction to the most recent Consumer Price Index (“CPI”) reading showing headline inflation of nearly 5% and core inflation notching the highest levels since 1991, one can assume that consensus currently favors the transitory argument.

Figure 1: Consumer Price Inflation – Headline & Core

Source: U.S. Department of Labor, FactSet as of 5/31/21

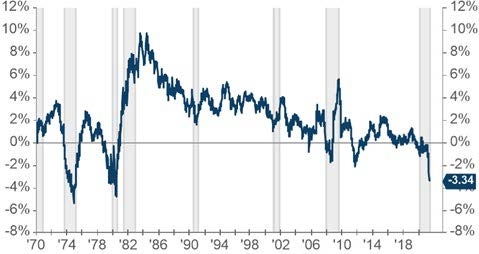

While we agree with some elements of the supporting logic, such as the notion that commodity prices will normalize over time (and are already appearing to do so), and supply chain bottlenecks will clear up, there are other elements that we fear are being too easily ignored. Real yields as defined by 10-year Treasury yield minus the headline inflation rate are now -3.3%, a level last reached during the worst inflationary years in the post-war period.

Figure 2: US 10y Benchmark Treasury Bond – Total CPI

Source: U.S. Department of Labor, FactSet as of 5/31/21

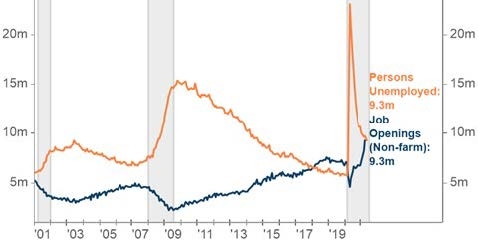

This is occurring at a time when financial conditions have never been easier, massive monetary and fiscal programs remain in place, and the labor market has one job available for every one person unemployed. Furthermore, consumers are flush with cash and experiencing an unprecedented wealth effect based on the speed in which their fortunes changed for the better. These consumers have significant pent-up demand to consume which has been restricted for the last 18 months. All these combine to create a backdrop with a relatively price-insensitive consumer that is accepting price increases, and a labor market that is extremely tight as wage pressure mounts across the system. Based on the current trajectory of the recovery and the seemingly unlimited policy support, it seems inevitable that we will experience a wage-price spiral and higher inflation as the year progresses, even if it pauses for a period as the commodity complex right sizes supply with demand.

Figure 3: Number of U.S. Job Openings vs Unemployed

Source: U.S. Department of Labor, Conference Board, FactSet as of 4/30/21

How to Invest in the Current Environment:

We expect the summer months to be choppy with periods like the one we just experienced following the FOMC meeting where a return to pure growth stocks occurs. There will undoubtedly be counter-trend trades to make, but we maintain conviction that the best way to invest in this type of environment is through exposure to high-quality growth cyclical businesses, particularly those with pricing power. We believe these businesses are best suited to navigate a rising interest rate environment and pass through rising input costs. For those best positioned, they may even be able to expand margins. We also believe that growth-at-any-price is best avoided here. Valuations will matter and quality is key. Ultimately, we expect the Fed to adjust course over time and pull forward their timelines for both tapering bond-purchases and raising interest rates.

Please email info@harborfunds.com or call 1-866-313-5549 if you have any questions or would like additional information about Harbor.

Legal Notices & Disclosures

All charts and data are for illustrative purposes only. Views expressed herein are drawn from commentary provided to Harbor by the subadviser, Westfield Capital Management, L.P. and may not be reflective of their current opinions or future actions, are subject to change without prior notice, and should not be considered investment advice.

The information provided in this presentation is for informational purposes only. The information provided in this article should not be considered as a recommendation to purchase or sell a particular security. The weightings, holdings, industries, sectors, and countries mentioned may change at any time and may not represent current or future investments.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborfunds.com or call 800-422-1050. Read it carefully before investing.

Performance data shown represents past performance and is no guarantee of future results.

Westfield Capital Management, L.P. is an independent subadviser to the Harbor Small Cap Growth Fund

Distributed by Harbor Funds Distributors, Inc.

*Redistributed with Westfield permission