Quantix Q2 2024 Newsletter

July 26, 2024

The second quarter of 2024 featured record-breaking prices across multiple different asset classes. While much attention has been focused on the historic rise in equity markets, several commodities also rose to all-time highs over the past several months. A common theme is emerging that is central to the best performers across both asset classes: Artificial Intelligence (“AI”).

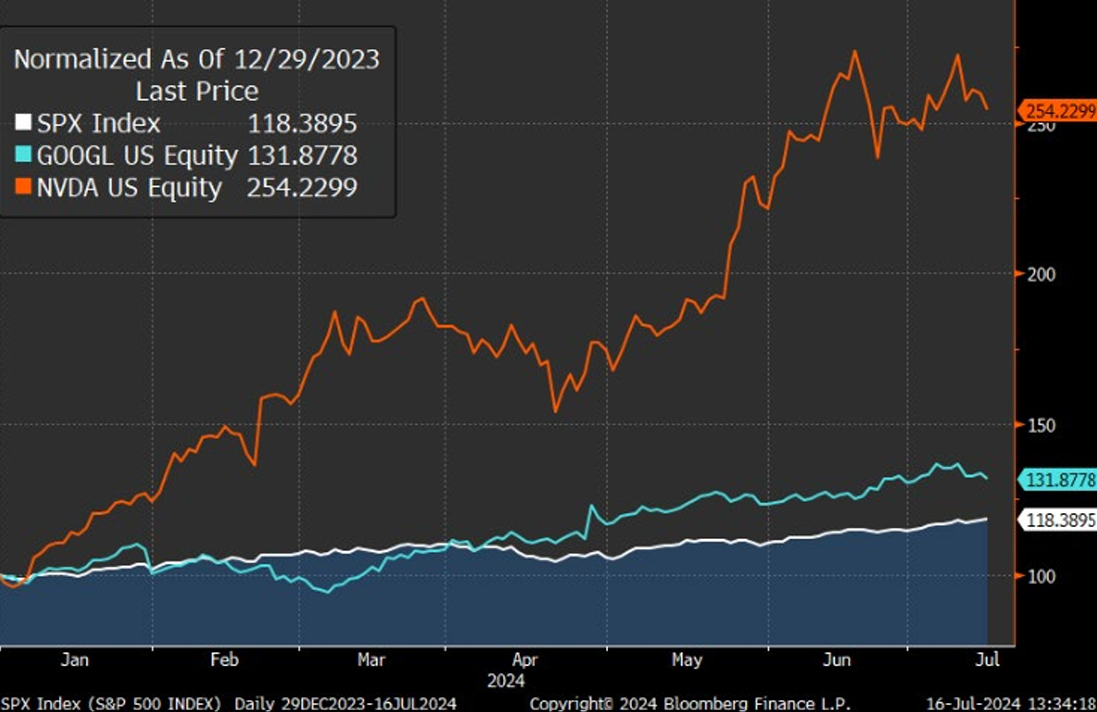

Equity investors are undoubtedly familiar with AI as a major 2024 investment theme. For example, as the primary chipmaker powering this revolution, NVIDIA has seen its market value skyrocket as vast amounts of capital have flown into this space.

Investors are now questioning the potential impact of AI on commodity markets and the considerations of how to invest in this space. The link between the physical nature of commodities and the digital nature of AI is something Quantix has dedicated considerable time examining and, in this newsletter, I will share our thoughts.

The awakening commodity bull market that I discussed in my last newsletter has been reinforced by AI. While broad based commodity indices were roughly unchanged over the second quarter, some notable dispersion masked powerful bullish themes that are driving many commodity prices higher. For example, in the past three months, Gold, Cocoa and Copper have all made all-time highs.

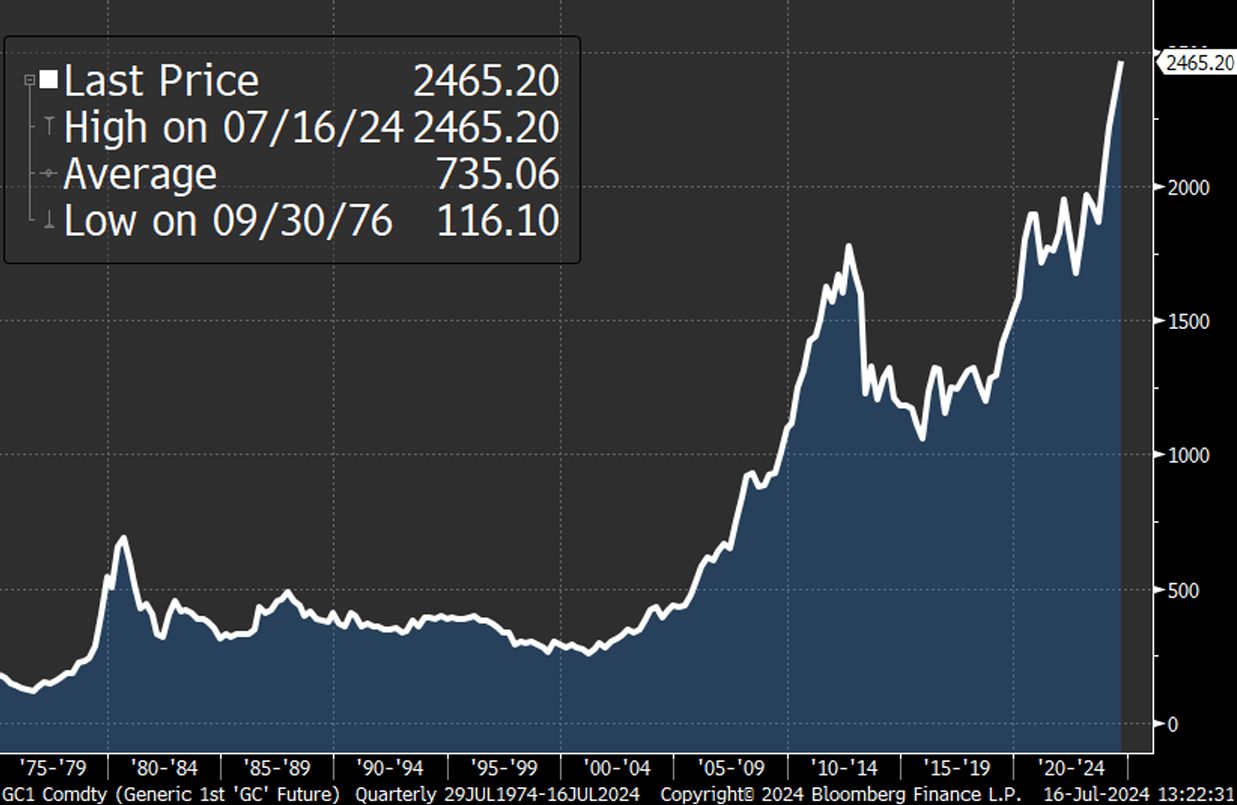

Gold

Source:

Bloomberg

Source:

Bloomberg

Gold continues to benefit from the de-dollarization of central bank reserves that I discussed in my Q1 2024 newsletter. Investor confidence in the US dollar continues to erode and, with no foreseeable end to ever-increasing and expanding US deficits, there is a mounting argument for a long-term structural rally in Gold.

On top of that, Quantix now believes the US Federal Reserve (“Fed”) will finally begin to cut rates, likely bringing the retail buyer back into Gold and Precious Metals more broadly, adding another catalyst for prices to potentially increase.

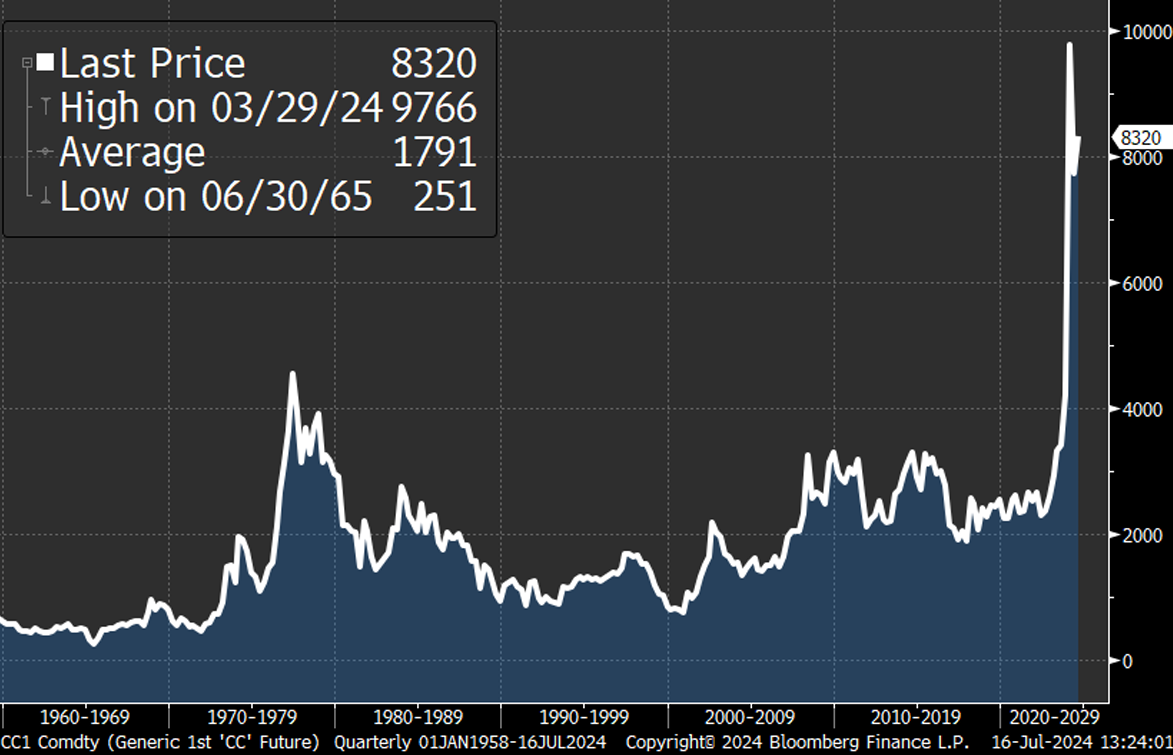

Cocoa

Source:

Bloomberg

Source:

Bloomberg

Cocoa has had an astonishing rally to record prices in 2024, principally driven by low supply in a highly inelastic market. The drought which ravaged Western Africa, an area that accounts for more than 60% of global production, is a poignant reminder of how climate change can inject higher volatility into various commodity markets.

Climate change is even more prominent in “tree” based agricultural products (such as cocoa, orange juice) which can take years to recover from a weather event relative to row crops (such as corn, wheat) which are more capable of responding to favorable weather in the following season.

Copper

Source:

Bloomberg

Source:

Bloomberg

Lastly, Copper has been the beneficiary of anticipated demand growth from both the Energy Transition and AI.

Similar to the birth of the internet in the 2000s, AI has the potential to revolutionize the world. I prefer AI to the Energy Transition as an investible theme in commodities because of the greater certainty of impact.

While the long-term, legal commitment to the Energy Transition remains firm, the short-term implementation can waiver according to the politics of the day, as we saw in Europe when Natural Gas and power prices spiked after the Ukraine invasion. The infrastructure spending and build out for AI, on the other hand, is happening in the immediate term.

The Energy Transition also requires government policy/subsidies in order to invoke change. AI is a private sector initiative, an arms race with the biggest and most well-capitalized entities on the planet manning the guns.

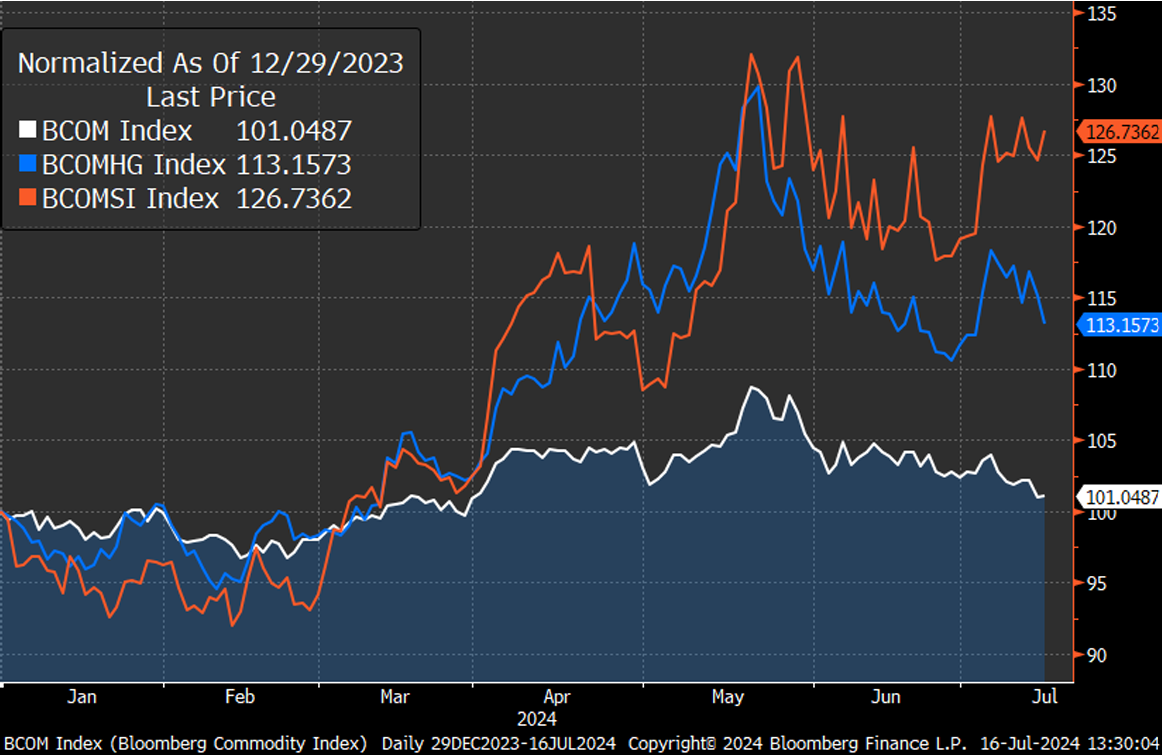

One obvious similarity between the effect of AI on equity markets and on commodity markets is in sector dispersion. Much has been made of the concentration of equity returns with select semiconductor chip stocks with a high exposure to AI significantly outperforming broader based indices.

In commodity markets, a similar effect is notable, with Copper and Silver significantly outperforming the Bloomberg Commodity Index (“BCOM”) so far in 2024.

December 29, 2023 - July 16, 2024

Source: Bloomberg

Source: Bloomberg

Gains in the AI-sensitive underliers have been impressive in both equities and commodities. Much attention has been focused on equity markets making all-time highs over the past quarter with NVIDIA driving the gains. Copper prices also rose to all-time highs in May, at one point up 30% year to date.

December 29, 2023 - July 16, 2024

Source: Bloomberg

Source: Bloomberg

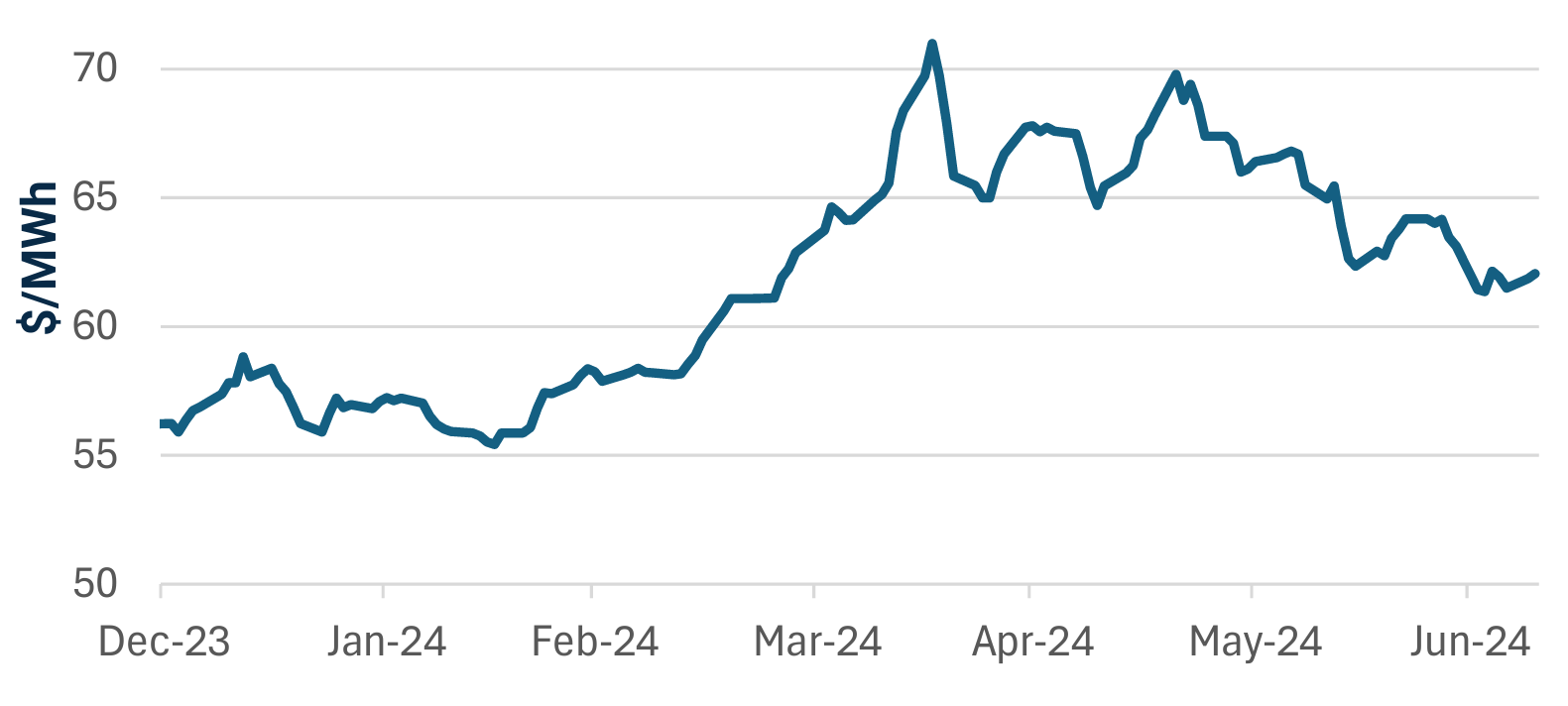

Forward Power markets also saw significant inflows over this period, pushing up the price of Pennsylvania-New Jersey-Maryland (PJM) Western Hub Real-Time Peak to over USD70 per MWh. We believe that this rise can be at least partially attributed to AI via anticipated incremental electricity demand from data centers.

Along with ongoing concerns around higher inflation, the emergence of the AI investing theme has unsurprisingly led to an increase in interest in our commodity solutions.

December 29, 2023 - July 16, 2024

Source: Bloomberg. MWh stands for Megawatt-Hour.

Source: Bloomberg. MWh stands for Megawatt-Hour.

The Impact of Artificial Intelligence on Commodity Markets

As they have done in the energy transition movement, commodity markets are set to play a critical role in the AI revolution. In Quantix's view, if the current prices for certain key commodities are not high enough, then they will need to rise to incentivize the necessary supply.

The Expected Demand Increase

The projected demand increase is significant and happening in the short term. The IEA1 recently estimated “an additional 160-590 TWh of electricity demand in 2026 compared to 2022, roughly equivalent to adding at least one Sweden or at most one Germany.”

Over 8,000 data centers exist, 33% of which are in the US, 16% in Europe and 10% in China2, consuming an estimated3 460 TWh in 2022, already between that of France and Germany4.

- At 2.9 watt-hours per ChatGPT request, AI queries are estimated to require 10x the electricity of traditional Google queries5, of which there were 8.5bn per day in 2023.

- In the next five years, consumers and businesses will generate twice as much data as the past 10 years. In response, total storage capacity in data centers and endpoint devices will more than double6, from 10.1 zettabytes (ZB) in 2023 to 21.0 ZB in 2027 for a five-year compound annual growth rate (CAGR) of 18.5%.

- Power usage effectiveness (PUE) - the amount of power a data center uses relative to its total energy consumption - improved considerably7 from 2007 to 2013 but has flattened over the past decade.

The Impact on Commodities

To power this revolution, additional electricity will need to be generated, stored and transmitted, resulting in an increase in physical commodity production.

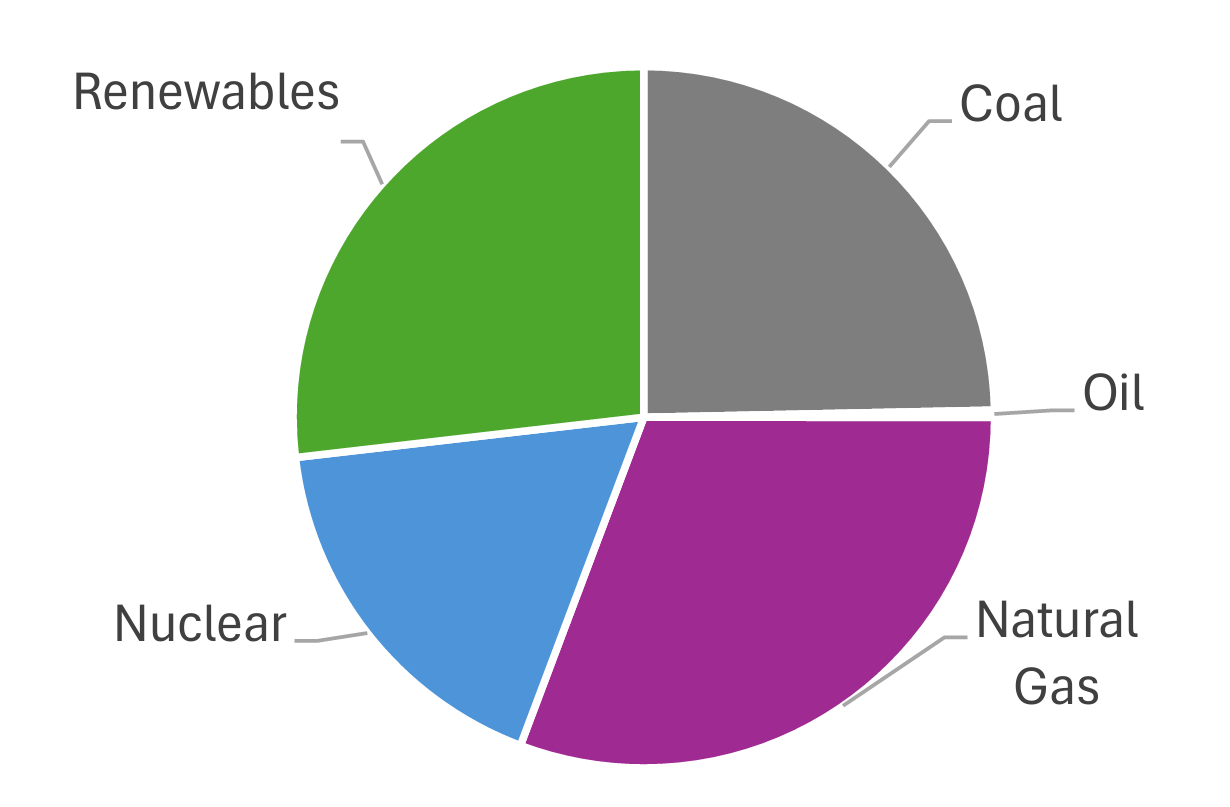

The current sources of electricity production in the US, Europe, and China, weighted by their share, are a mix of Coal, Natural Gas, Nuclear, and Renewables. Although the commodity sources of Coal, Natural Gas, and Nuclear Power are straightforward, Renewables in the form of wind and solar can require a wide range of commodities as inputs for the build out, such as Copper, which Quantix has written about in previous white papers.

Source: Quantix Commodities, IEA, Goldman Sachs, July 2024.

Source: Quantix Commodities, IEA, Goldman Sachs, July 2024.

The same commodities are required for the transformers, power lines, and underground cables that are necessary to double the size of the existing grid by 20408. Copper and Aluminum are the most effective commodities (although Steel plays a significant role) and in 2022-30, this source of demand is projected to be almost 18% of 2021 copper production and almost 23% of 2021 aluminum production9.

There are similarities to the broader and longer-term energy transition:

- Given current commodity prices, there will likely be insufficient supplies to fuel the buildout of the new electricity generation and transmission capacity necessary for the estimated incremental power demand. Prices of relevant commodities will likely have to rise in order to incentivize production.

- Just as operators of solar or wind farms are effectively “short” commodities as input costs, data center margins could be squeezed as the prices of those commodity inputs rise, hurting returns. Investors can diversify portfolios by investing in the underlying commodities.

- The investment required to increase production of both power and primary commodities could be passed on to electricity consumers (not just data center operators but all power consumers) creating a source of potential higher inflation.

- Increased global political tensions are adding to a trend of onshoring/friendshoring10 which may result in society building more data centers than necessary.

The impact on commodities falls into four broad groups:

- Power prices may need to rise to facilitate the additional investment in generation capacity, although there are potential political considerations if prices rise.

- Fuel-related commodities are needed, including Coal, which is still a significant portion of the power mix in the US and Europe (and over 60% in China). Natural Gas is the largest source of electricity in the US, the largest data center market11. Uranium is necessary for nuclear reactors; China alone has planned or proposed to build an additional 200 nuclear reactors by 203012, increasing the current global total of 440 by nearly half.

- Infrastructure-related commodities such as Industrial Metals will be required to connect the new electricity build-out to the grid, regardless of power source. The mix of metals differs depending on whether the incremental power comes from renewables or fossil fuels, but there will likely be an increase in overall demand. Battery metals will also be necessary to meet the increase in storage capacity required by the combination of an increase in total power generation and renewables' share of it.

- Emissions allowances will likely remain important to offset the uptick in electricity production of the overall global energy mix. As a result, given current sources of generation, the cost of carbon will likely increase.

There are medium-term trends which can also impact these commodities:

- Technological evolution may mean that inputs into electricity generation and storage, as well as data center efficiency may change, which could render some commodities redundant or change their demand profile. These fundamental changes can be incorporated in an active approach to investing.

- Political changes may mean governments taking action, such as capping power prices or carbon prices, as we witnessed in Europe after the Russian invasion of Ukraine.

- Production responses should eventually happen if prices of a commodity rise sufficiently. Although the response time is long in the case of some commodities (such as Copper), in others it can be much shorter. For example, in Lithium, production has roughly tripled over the past 4 years, driven by a sevenfold increase in Chinese battery grade prices13.

How to Invest in these Commodities

To define an investable universe from the above, geography and liquidity need to be considered.

Power exposure can be generated through electricity contracts in the US and Europe (specifically UK & Germany). Liquidity is generally limited in other markets such as Japan, Australia, and New Zealand.

Fuel-related commodities such as Natural Gas can be gained through US (HH), European (TTF and NBP) and Asian Natural Gas (JKM), and Uranium through OTC exposure to UxC Uranium U3O8.

Infrastructure-related commodities such as industrial metals can be gained via Copper, Aluminum, Nickel, Zinc, Lead, Tin, Iron ore and Silver. Battery metals exposure can be gained via Cobalt and Lithium.

Emissions allowances exposure can be gained on a global basis through EUAs (European Union Allowances), CCAs (California Carbon Allowances), UKAs (United Kingdom Allowances), and RGGIs (Regional Greenhouse Gas Initiative allowances).

Coal has been removed from the investable universe above, given environmental considerations as well as the world's commitment to decarbonization.

The mechanics of investing in commodity futures can have a significant impact on the returns that an investor receives. Quantix believes that an active approach by a skilled manager may improve these returns by incorporating the following factors:

- Liquidity - as markets evolve, liquidity may increase (such as in power) or decrease in commodities that are overtaken by technological change (potentially Nickel). With an active approach, there are certain commodities that, although less liquid, may still present investment opportunities, depending on the time horizon of the investor and size of investment. In less liquid commodities, managers can opportunistically provide liquidity to the market by utilizing execution relationships.

- Carry costs - the cost of carry is a key consideration that can significantly affect returns. For example, US Natural Gas had an approx. -25% annualized negative carry since 2000, according to Bloomberg. An active approach can take this into consideration, incorporating the cost of carry into weight decisions while investing in different parts of futures curves.

- Transaction costs - similar to carry costs, entry and exit costs can create a significant headwind even if the investment thesis is sound. An active approach can incorporate this into weighting decisions as well as potentially reducing the impact through opportunistic liquidity opportunities.

Quantix believes that an actively managed exposure can incorporate these factors to help enhance the risk/return available to investors in this space. The Quantix team has experience trading a large variety of assets in this universe and has a demonstrated track record of adding value over passive exposures across different types of strategies, including the energy transition space.

Conclusion

The expanded use of AI over the coming years is expected to have a profound impact on commodity markets. In this letter I have expressed Quantix's view of where we believe that impact will be most notable in terms of demand and outlined the important considerations for how to invest in those opportunities.

One thing I have not discussed is the possible effects of AI on commodity supply. Indeed, AI is often hailed as a deflationary force, given the productivity gains it could potentially generate. We believe that the dispersion we've recently witnessed in financial markets is set to continue for the foreseeable future. The corporations that are key to enable AI will likely outperform those that are not. More relevant for Quantix and our investors, is that the commodities that are necessary for AI (such as power, conducting metals, fiber) will likely outperform those whose supply potentially benefits from using it (such as agriculture).

Overall, it is increasingly apparent that commodity markets are reacting to a variety of significant investment phenomena. Inflation, the Energy Transition, and now artificial intelligence are some of the most relevant examples of forces that may create substantial investment opportunities, with the AI theme more likely to have a near-term impact than a longer-term theme such as the Energy Transition.

We believe Quantix's singular focus and expertise in the asset class puts us in an ideal position to identify these opportunities and seek to take advantage of them on behalf of our investors, no matter whether the portfolio goals are uncorrelated alpha or directional beta exposure. As always, we look forward to speaking with you about how our investment products and commodity knowledge can benefit your portfolio.

Sincerely,

Don Casturo

CIO, Quantix Commodities LP

Important Information

Sources:

- IEA - Electricity 2024

- AI, data centers and the coming US power demand surge - Goldman Sachs

- Ibid IEA

- https://yearbook.enerdata.net/electricity/electricity-domestic-consumption-data.html

- Powering Intelligence: Analyzing Artificial Intelligence and Data Center Energy Consumption

- Revelations in the Global Storage Sphere 2023, John Rydning

- Investing in the rising data center economy - McKinsey.

- IEA - Electricity Grids and Secure Energy Transitions

- Ibid. IEA

- WSJ “U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs”

- Goldman Sachs, AI Data Centers and the Coming US Power Demand Surge

- World Nuclear Association, 'Plans For New Reactors Worldwide.' June 2024. https://world-nuclear.org/information-library/current-and-future-generation/plansfor-new-reactors-worldwide.

- Goldman Sachs Research, “Battery Metals Watch: The bear market is far from over”

The views expressed herein are those of Quantix Commodities at the time the comments were made. These views are subject to change at any time based upon market or other conditions, and the author/s disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness.

Performance data shown represents past performance and is no guarantee of future results.

The Bloomberg Commodity Index (“BCOM”) is designed to be a highly liquid and diversified benchmark for commodity investments via futures contracts. The Bloomberg Copper Subindex is a commodity group subindex of the BCOM composed of futures contracts on Copper. It reflects the return of underlying commodity futures price movements. The Bloomberg Silver Subindex is a commodity group subindex of the BCOM composed of futures contracts on Silver. It reflects the return of underlying commodity futures price movements. The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

Alpha refers to excess returns earned on an investment above the benchmark return when adjusted for risk.

Beta compares a stock or portfolio's volatility or systematic risk to the market.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions.

Forecast and estimates are based on hypothetical assumptions and for informational purposes only.

References to specific company securities are for illustration only and should not be construed as an offer or solicitation from Harbor Capital to buy or sell any securities.

Commodities Risk - The value of commodities investments will generally be affected by overall market movements and factors specific to a particular industry or commodity including weather, embargoes, tariffs, or health, political, international and regulatory developments.

Harbor Capital Advisors, Inc.

3751055